What is the difference between buying and selling shares, and investing in a business?

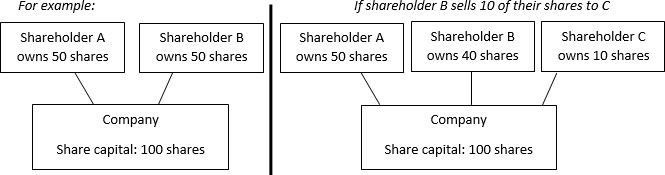

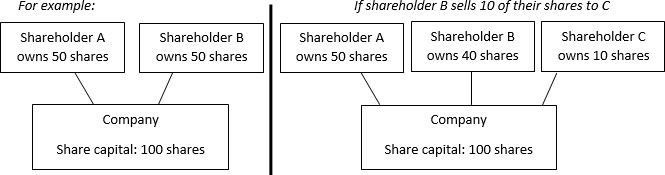

Buying and selling shares refers to an existing shareholder selling some or all of their shares in a company to another person. This might be between existing shareholders, or other people who are not already shareholders. The purchase price for the shares will be paid to the seller, and not to the company itself. The number of shares in issue does not increase.

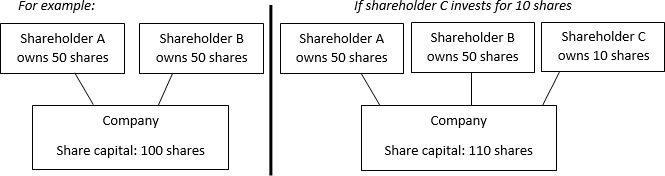

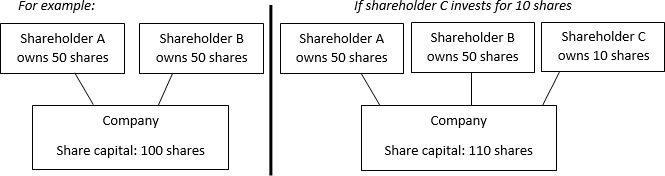

Investing in a business means agreeing to invest in the company itself in exchange for the allotment and issue of new shares in the company to the incoming shareholder. The investment money is paid to the company, and not to the existing shareholders. This also results in the share capital in the company being increased by the number of new shares issued.

The rest of this page will focus on purchasing shares from a shareholder.

Who can buy and sell shares in a company?

In most private companies (i.e. not PLCs) any restrictions on buying and selling shares will be set out in the company’s articles of association, and possibly in a shareholders agreement if there is one.

Conversely, it is also common for a company’s articles of association to include provisions which automatically compel a shareholder to sell their shares on the happening of certain events (for example if they leave their position of employment, are made bankrupt, or are convicted of a serious criminal offence). In these cases, provided such a “trigger event” occurs, then the shareholder’s shares would automatically be deemed to be transferred on the terms set out within the articles or shareholder agreement.

It is also possible for the company to purchase the shares owned by its shareholder, known as a “buy back”. Separate rules apply to company share buy backs.

What restrictions might there be on buying or selling shares?

The most common restriction would be what are called “pre-emption rights”. At their core, pre-emption rights give the existing shareholders (and sometimes the company itself) the right of first refusal over the sale of any shares in the company. This means that the other shareholders must be given the right to purchase the shares before they are sold to a third party, usually at the same price at which the seller intends to sell them to a third party.

If there are pre-emption rights in place, then usually the shares may only be sold to a third party if:

- the procedure set out in the articles of association has been followed and the existing shareholders have declined to purchase the shares (or some of them);

- the existing shareholders have agreed to waive their rights of pre-emption over the proposed transfer;

- the shareholders have passed a written resolution to disapply the pre-emption rights; or

- the particular transfer is permitted in the company’s articles of association.

If the existing shareholders have a shareholder agreement in place, then there is likely to be a requirement in that agreement that new incoming shareholders must sign a “deed of adherence” to that agreement to ensure that they are bound by its terms.

How are shares in a company bought and sold?

When selling the shares, the buyer and the seller will agree various terms between them as to the basis on which the shares will be sold. The terms will vary from case to case, and will be influenced by a number of factors including the nature of the business, whether other shareholders are in the company, the value of the sale etc.

At its simplest form, shares are transferred by the execution of a stock transfer form by the seller in favour of the buyer. However, typically a share purchase agreement would be agreed between the parties, which would deal with a lot of key issues including:

- setting out the purchase price and the terms of payment (i.e. all up front, by instalments etc.);

- any warranties (i.e. promises) that the seller may give about the shares, the extent of which will vary depending on the nature and size of the share sale;

- any restrictions on the seller (such as not being able to be involved in a competing business for a period following the shares).

How is the value of shares calculated?

The value paid for the shares will very much depend on the circumstances of the sale and purchase, and any relevant provisions in the company’s articles of association or other relevant agreements (such as a shareholder agreement).

Relevant provisions to look for include:

- an agreed formula by which value is calculated;

- a specific expert (usually an accountant) being set as the individual to determine value;

- so-called “good leaver” and “bad leaver” provisions.

Is stamp duty payable?

Stamp duty is payable to HMRC on the purchase of shares, calculated as 0.5% of the price paid (rounded up to the nearest £5), provided the total consideration is £1,000 or more.

If you need any advice on buying and selling shares in a business, please contact a member of our corporate and commercial law team in confidence here or on 02920 829 100 for a free initial call to see how they can help.