How is investing in a company different from buying shares?

When an investor invests in a company, the company issues new shares to the investor in exchange for the investment. Usually, the investment is for cash paid into the capital of the company, however, it is possible to have non-cash investment. Assuming cash is paid, it is paid to the company itself, and the shares are issued to the investor who becomes a shareholder in the company.

When buying shares from an existing shareholder, the buyer still becomes a shareholder of the company, however instead of paying the investment to the company, the purchase price for the shares is paid to the shareholder selling the shares.

This page deals with investment into a new company.

How to invest in a company?

The process of investing will depend on the individual circumstances of the investment. For example, if an individual is investing in a friend or family’s business, then the process will usually be much simpler than the process a venture capitalist of angel investor would want to follow. In addition, if an investor comes through a funding platform, then the process is likely to be different again.

As a general rule of thumb, the higher the investment amount and the more experienced the investor, the more paperwork and protections they are likely to seek. An individual investing a small sum of money in a friend or family’s business is often less concerned with shareholder protections.

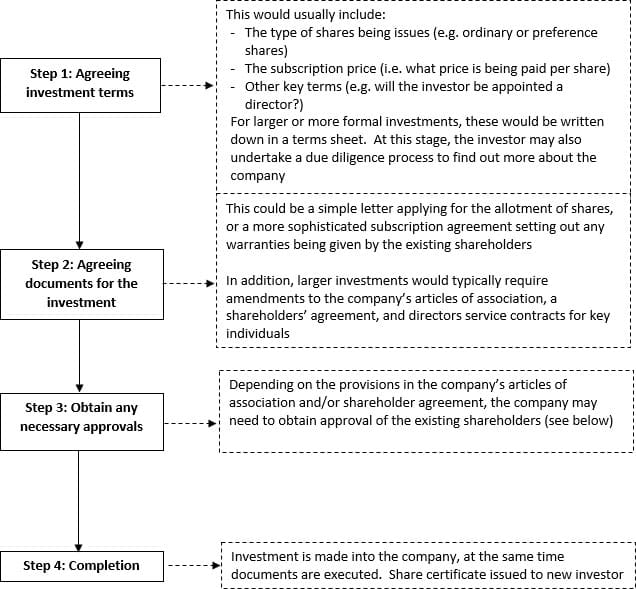

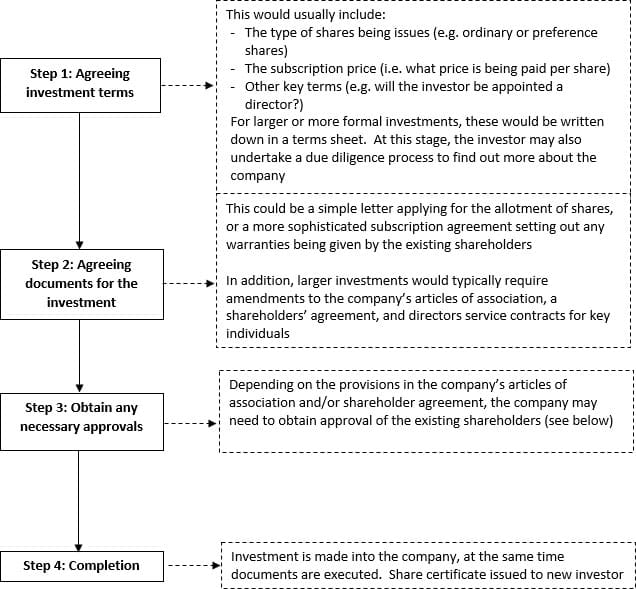

However, at its core, an investment would usually follow the same journey:

What restrictions might there be on new investments?

Restrictions on (or conditions to) the issue of new shares in a company may be set down in:

- The Companies Act 2006

- The company’s articles of association

- A shareholder agreement

These should all be checked carefully by the company before beginning the investment process.

Typical restrictions and conditions to look out for include:

- Requirement for shareholder approval

- Pre-emption rights, giving existing shareholders the right of first refusal over the issue of new shares (at the same subscription price)

- “Anti-dilution” clauses, which protect some shareholders from having their shareholding in the company from being diluted (i.e. reduced) as a result of the new allotment of shares.

- Requirement to sign up to any shareholder agreement already in place (usually by signing what is called a “deed of adherence”)

Is stamp duty payable?

No, stamp duty is not payable on an investment in a company.

If you need any advice on investing in a company, please contact a member of our corporate and commercial law team in confidence here or on 02920 829 100 for a free initial call to see how they can help.